Digital Lending Platform Market Demand 2025, Analysis Key Players, Size, Share and Report by 2033

IMARC Group’s latest report, titled “Digital Lending Platform Market Report by Type (Loan Origination, Decision Automation, Collections and Recovery, Risk and Compliance Management, and Others), Component (Solutions, Services), Deployment Model (On-premises, Cloud-based), Industry Vertical (Banks, Insurance Companies, Credit Unions, Savings and Loan Associations, Peer-to-Peer Lending, and Others), and Region 2025-2033”, offers a comprehensive analysis of the digital lending platform market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The global digital lending platform market size reached USD 13.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 39.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.85% during 2025-2033.

Request Free Sample Report (Exclusive Offer on this report): https://www.imarcgroup.com/digital-lending-platform-market/requestsample

Technological Advancements and Integration:

The integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and blockchain is revolutionizing digital lending platforms. AI and ML algorithms enhance credit scoring models by analyzing vast datasets to assess borrower risk more accurately, leading to quicker and more informed lending decisions. Blockchain technology offers secure and transparent transaction processes, reducing fraud and ensuring data integrity. These innovations not only streamline operations but also improve customer experiences by providing faster loan approvals and personalized financial products. For instance, companies like Upstart Holdings have leveraged AI to achieve substantial growth, reporting a 56% year-over-year revenue increase to $219 million, with the number of loans jumping 89% to 245,663.

Regulatory Support and Financial Inclusion Initiatives:

Government initiatives and regulatory frameworks are playing a pivotal role in the expansion of digital lending platforms. Policies promoting digital financial services aim to enhance financial inclusion, particularly in underserved regions. By encouraging the adoption of digital lending, authorities seek to provide accessible credit options to individuals and small businesses lacking traditional banking services. This support not only fosters industry growth but also ensures consumer protection and financial system stability. For example, in June 2024, Salesforce unveiled its digital lending platform to empower government agencies and public sector organizations in India to enhance citizen experiences.

Shift in Consumer Behavior Towards Digitalization:

The increasing consumer preference for digital solutions is significantly influencing the digital lending platform market. The demand for convenient, fast, and paperless loan processes has led to a decline in traditional lending methods. Digital platforms offer streamlined application procedures, real-time approvals, and personalized loan products, aligning with modern consumers' expectations. This shift is further accelerated by the proliferation of smartphones and internet connectivity, enabling borrowers to access lending services anytime and anywhere. Consequently, financial institutions are compelled to adopt digital lending platforms to remain competitive and meet evolving customer demands. According to DataReportal, in 2022, the number of smartphones in use is rising at a 5.1% annual rate, with an average of 1 million smartphones coming into use every day.

Leading Key Players Operating In the Digital Lending Platform Industry:

- Black Knight Inc

- Finastra

- FIS, Fiserv Inc

- Intellect Design Arena Ltd

- Intercontinental Exchange Inc

- Nucleus Software Exports Ltd

- Pegasystems Inc

- Roostify Inc

- Tavant Technologies

- Wipro Limited

Emerging Trends in Digital Lending Platforms:

The digital lending landscape is witnessing several emerging trends shaping its future trajectory. One notable trend is the rise of peer-to-peer (P2P) lending platforms, which connect borrowers directly with investors, bypassing traditional financial intermediaries. This model offers competitive interest rates and has gained traction among tech-savvy consumers seeking alternative financing options. Additionally, the adoption of cloud-based solutions is on the rise, providing scalability, reduced operational costs, and enhanced data analytics capabilities for lenders. The focus on customer-centric approaches is also intensifying, with platforms leveraging data analytics to offer personalized loan products and improve user experiences. Furthermore, strategic partnerships between traditional financial institutions and fintech companies are becoming more prevalent, aiming to combine strengths and expand market reach. These trends indicate a dynamic and evolving market, with stakeholders continually innovating to meet the changing needs of borrowers and stay ahead in a competitive landscape.

Ask Analyst for Instant Discount and Download Full Report with TOC & List of Figure: https://www.imarcgroup.com/digital-lending-platform-market

Digital Lending Platform Market Report Segmentation:

Breakup by Type:

- Loan Origination

- Decision Automation

- Collections and Recovery

- Risk and Compliance Management

- Others

Loan origination accounts for the majority of shares due to its essential role in streamlining the lending process, enabling lenders to efficiently assess and approve loans while enhancing customer experience.

Breakup by Component:

- Solutions

- Services

Solutions account for the majority of shares due to their comprehensive capabilities in managing various aspects of the lending process

Breakup by Deployment Model:

- On-premises

- Cloud-based

On-premises accounts for the majority of shares due to the heightened demand for data security and control over sensitive financial information, as many financial institutions prefer to maintain their infrastructure on-site.

Breakup by Industry Vertical:

- Banks

- Insurance Companies

- Credit Unions

- Savings and Loan Associations

- Peer-to-Peer Lending

- Others

Banks account for the majority of shares due to their significant investment in digital transformation initiatives, which aim to improve operational efficiency and customer engagement through advanced lending technologies.

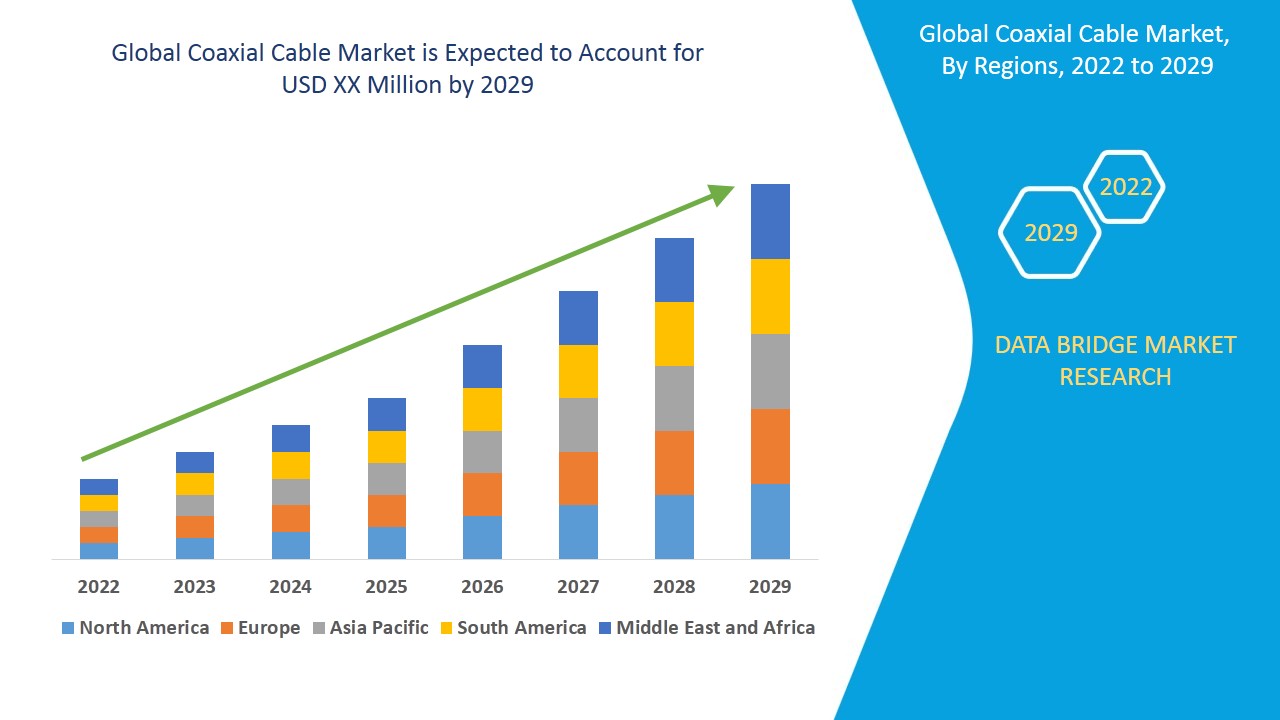

Breakup by Region:

- North America (United States, Canada)

- Europe (Germany, France, United Kingdom, Italy, Spain, Others)

- Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Other)

North America holds the leading position owing to the rising popularity of peer-to-peer lending platforms.

Key Highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- Porter’s Five Forces Analysis

- Market Drivers and Success Factors

- SWOT Analysis

- Value Chain

- Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145