Collection Agency Surety Bonds

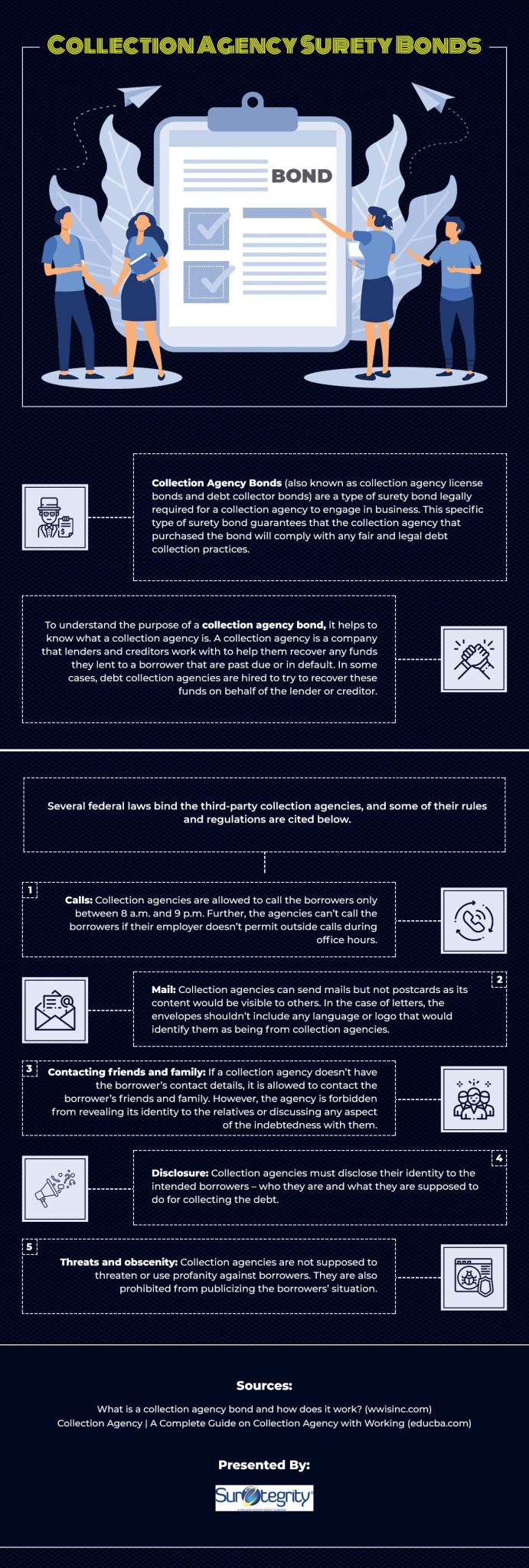

The infographic titled "Collection Agency Surety Bonds" provides a detailed overview of why surety bonds are essential for collection agencies and how they function. It explains that surety bonds are often required by law to ensure agencies operate in an ethical manner, protecting clients and creditors from potential malpractices. These bonds involve three key parties: the obligee (usually the government or creditor), the principal (the collection agency), and the surety (the bond issuer).

The bond guarantees that the agency adheres to regulations, and if it fails to do so, the surety compensates the harmed party. The infographic outlines that obtaining a surety bond helps agencies build trust with clients and maintain compliance with state regulations, ultimately safeguarding the financial interests of creditors. It also emphasizes the importance of understanding bond requirements, as they vary depending on the location and nature of the business.

By securing a surety bond, collection agencies not only fulfill legal obligations but also demonstrate their commitment to professionalism and ethical practices. This bond acts as a financial safety net for creditors, ensuring their protection if an agency fails to meet legal standards. Overall, the infographic highlights the bond's role in maintaining accountability and fostering trust in the debt collection industry.