Sustainable Finance Market Overview, Outlook, CAGR, Growth, Share, Value , Industry Overview and Forecast to 2031

"Sustainable Finance Market Size And Forecast by 2031

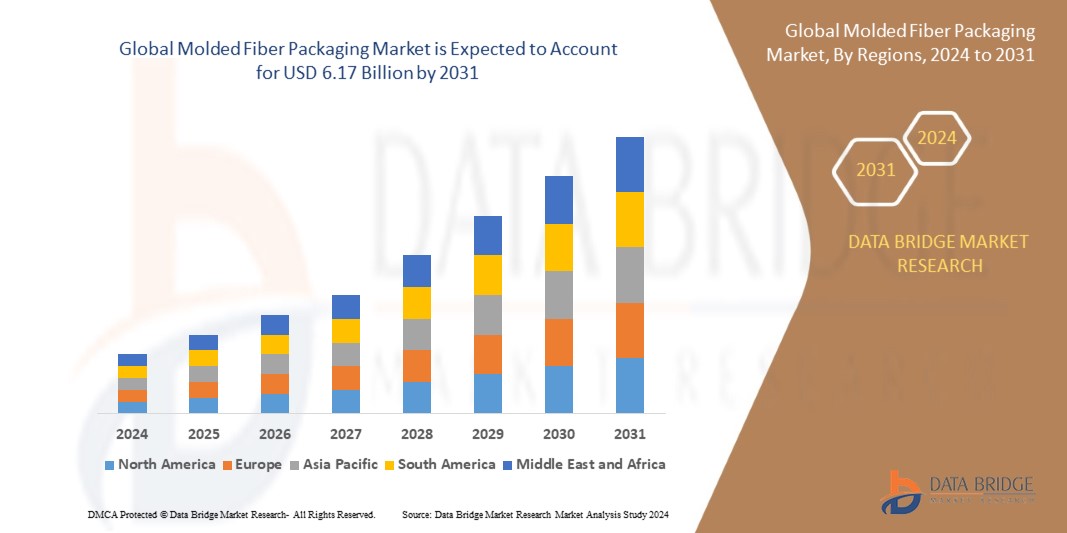

Data Bridge Market Research analyses that the global sustainable finance market which was USD 4.56 billion in 2023, would rocket up to USD 20.09 billion by 2031, and is expected to undergo a CAGR of 20.36% during the forecast period.

Lastly, the study emphasizes the broader implications of these companies’ contributions to the Sustainable Finance Market growth and evolution. Their strategies, technological advancements, and market influence not only define current industry trends but also set the stage for future developments. By providing a comprehensive overview of the leading players, the report equips stakeholders with critical insights to understand competitive positioning, identify opportunities for collaboration, and develop strategies to thrive in this dynamic industry.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-sustainable-finance-market

Nucleus is a secure, cloud-based platform designed to streamline data transfer and management for businesses. Its intuitive interface offers practice administrators and financial managers advanced filtering options, enhancing operational efficiency. By integrating various data sources, Nucleus enables effective prioritization of critical exposures, incorporating business context and threat intelligence to bolster security measures. Additionally, Nucleus supports seamless collaboration among multiple users across different applications, fostering rapid iteration and teamwork. Its deployment flexibility allows installation on-premises or via preferred cloud service providers, ensuring scalability and adaptability to meet diverse organizational needs.

Get More Detail: https://www.databridgemarketresearch.com/nucleus/global-sustainable-finance-market

Which are the top companies operating in the Sustainable Finance Market?

The Top 10 Companies in Sustainable Finance Market operating in the Sustainable Finance Market are recognized for their innovation, market leadership, and strong presence across key regions. These companies invest heavily in research and development, driving continuous product innovation to meet evolving customer demands. Their extensive distribution networks, brand reputation, and technological expertise have solidified their positions as industry leaders. Additionally, these top companies are expanding through strategic partnerships, mergers, and acquisitions, enabling them to strengthen their market share and enhance their competitive advantages.

**Segments**

- **By Offering**: The sustainable finance market can be segmented based on the offering into green bonds, social bonds, sustainability bonds, green loans, social loans, sustainability loans, and green mortgages. Green bonds are debt securities utilized to fund projects that have positive environmental impacts. Social bonds are issued to finance projects aimed at addressing social issues such as healthcare and education. Sustainability bonds encompass both environmental and social initiatives. Green loans, social loans, and sustainability loans are loans provided to businesses or individuals for environmentally or socially responsible projects. Green mortgages are loans designed to finance energy-efficient homes.

- **By Instrument Type**: In terms of instrument type, the sustainable finance market can be categorized into equity, debt, and derivatives. Equity instruments involve ownership interests in companies that prioritize sustainable practices. Debt instruments, such as green bonds and sustainability loans, involve borrowing which must be repaid with interest. Derivatives are financial contracts whose value is derived from an underlying asset or benchmark and can be used for risk management or speculation in sustainable finance.

- **By End-User**: The sustainable finance market can also be segmented based on end-user into retail investors, institutional investors, corporations, and governments. Retail investors are individual investors looking to make sustainable investments. Institutional investors include pension funds, insurance companies, and sovereign wealth funds that allocate significant capital to sustainable projects. Corporations seek sustainable finance for their environmental and social initiatives. Governments use sustainable finance to fund public projects that align with sustainability goals.

**Market Players**

- **JP Morgan Chase & Co**: A leading player in the sustainable finance market, JP Morgan offers a wide range of sustainable financial products and services to clients worldwide.

- **Bank of America Corporation**: Bank of America is actively involved in sustainable finance, providing green bonds, social financing solutions, and sustainable investment opportunities.

- **UBS Group AG**: UBS is a key player in sustainable finance, offering sustainable investment strategies, ESG integration services, and advisory solutions to its clientsJP Morgan Chase & Co., Bank of America Corporation, and UBS Group AG are three key players dominating the sustainable finance market. With the increasing focus on environmental, social, and governance (ESG) factors, these institutions have strategically positioned themselves to cater to the growing demand for sustainable financial products and services. JP Morgan Chase & Co. stands out for its comprehensive range of sustainable offerings, catering to clients globally. The institution's expertise in structuring green bonds, social bonds, and sustainability loans has earned it a prominent position in the market. As a trusted financial partner, JP Morgan Chase & Co. leverages its vast network and resources to drive sustainable initiatives across various industries and regions.

Bank of America Corporation is another significant player in sustainable finance, known for its innovative approach to ESG integration. The institution's commitment to sustainability is reflected in its diverse portfolio of green bonds, social financing solutions, and sustainable investment opportunities. By providing tailored financial products that align with environmental and social goals, Bank of America Corporation has established itself as a leading provider of sustainable finance solutions. Furthermore, the institution's emphasis on transparency and accountability in sustainable investing has resonated well with investors and clients seeking impactful ESG strategies.

UBS Group AG has emerged as a key player in sustainable finance, offering a wide range of sustainable investment strategies and advisory services. With a strong focus on ESG integration, UBS provides clients with access to sustainable financial products that align with their values and financial objectives. The institution's expertise in driving sustainable growth and impact investing has positioned it as a trusted partner for investors seeking to incorporate ESG factors into their investment decisions. UBS Group AG's commitment to sustainable finance is evident in its strategic collaborations and initiatives aimed at promoting responsible investing practices and driving positive change in the financial industry.

Overall, these market players exemplify the growing importance of sustainable finance in today's market landscape. As more investors, corporations, and governments prioritize sustainability, institutions like JP Morgan Chase & Co., Bank of America Corporation**Market Players**

- BlackRock, Inc. (U.S.)

- Refinitiv (U.S.)

- Acuity Knowledge Partners (U.S.)

- NOMURA HOLDINGS, INC (Japan)

- Aspiration Partners, Inc. (U.S.)

- Bank of America (U.S.)

- BNP Paribas (France)

- Goldman Sachs (U.S.)

- HSBC Group (U.K.)

- KPMG International (Netherlands)

- South Pole (Switzerland)

- Deutsche Bank AG (Germany)

- Stripe, Inc. (U.S.)

- Tred Earth Limited (U.K.)

- Triodos Bank UK Ltd. (U.K.)

- UBS (Switzerland)

- Starling Bank (U.K.)

- Clarity AI (U.S.)

The sustainable finance market continues to witness significant growth and evolution, driven by the increasing focus on environmental, social, and governance (ESG) factors. The segmentation of the market by offering, instrument type, and end-user provides a comprehensive understanding of the diverse opportunities available within this sector. Green bonds, social bonds, sustainability bonds, green loans, and other financial instruments cater to various sustainability initiatives, while targeting different investor profiles and project scopes. Institutional investors, corporations, governments, and retail investors form a diverse base of end-users actively participating in sustainable finance activities.

Market players such as JP Morgan Chase & Co., Bank of America Corporation, and UBS Group AG have established themselves as key players in the sustainable

Explore Further Details about This Research Sustainable Finance Market Report https://www.databridgemarketresearch.com/reports/global-sustainable-finance-market

Key Insights from the Global Sustainable Finance Market :

- Comprehensive Market Overview: The Sustainable Finance Market is expanding rapidly, fueled by technological innovation and increasing global demand.

- Industry Trends and Projections: Automation, sustainability, and digital solutions are key trends, with the market projected to grow at a significant rate.

- Emerging Opportunities: New opportunities are arising in green technologies and personalized solutions, especially in emerging markets.

- Focus on R&D: Companies are heavily investing in R&D to drive innovation, focusing on AI, IoT, and sustainability.

- Leading Player Profiles: Market leaders like Company A and Company B maintain dominance through strong portfolios and extensive networks.

- Market Composition: The market is fragmented, with a mix of established players and emerging startups targeting various segments.

- Revenue Growth: The market is experiencing steady revenue growth, driven by both consumer and commercial demand.

- Commercial Opportunities: Key commercial opportunities lie in expanding into new regions, leveraging digital transformation, and strategic collaborations.

Get More Reports:

Upstream Oil and Gas Water Management Services Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Hepatorenal Syndrome Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2032

Chronic Kidney Disease - Mineral Bone Disorders (CKD-MBD) Treatment Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Polycarbonate Sheets Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Corrosion Inhibitors Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Speech Generating Devices Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Software Testing Services Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Food Coating Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Europe Food Storage Container Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2031

Security and Vulnerability Management Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Commercial Telematics Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2028

Asia-Pacific Ambulatory Infusion Pumps Market Size, Share, and Trends Analysis Report – Industry Overview and Forecast to 2029

Data Bridge Market Research:

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975